BUY WITH TODD KINGSLEY REAL ESTATE GROUP

STEP 1: BROWSING & GATHERING

FIND THE PERFECT HOME

Our system uses the most advance technology to find you next home. We help you to discover the perfect home and neighborhood for your lifestyle. Browse 1M+ real-time MLS listings with our smart filters and receive a daily, weekly or monthly alert with all the new properties. Be the first one to know about a new home.

UNDERSTANDING YOUR BUDGET

Make an estimate of how much you can afford based on your income and current debt. Lenders recommend that your monthly debts should be no more than 36% of your monthly income. Other debts such as student loans or credit cards must be added to that monthly payment. You can use the mortgage calculator bellow to help you calculate your borrowing power.

YOUR CREDIT SCORE

Your credit history is one of the principal measures used by a lender to determine your interest rate. The better your credit, the better lending terms you get. You should we aware of what information is on your credit report by obtaining and reviewing copies of your credit report directly from the three main credit agencies. You can request a free report

STEP 2: CONNECT WITH A LENDER

GATHER ALL DOCUMENTS

TYPE OF LOANS

Not all mortgages are structured the same. There are several borrowing options for home buyers and the type of loan that you choose should work for your unique financial institution. Most loans have fees in addition to the total amount you are borrowing. Some fees are due up front and some at closing.

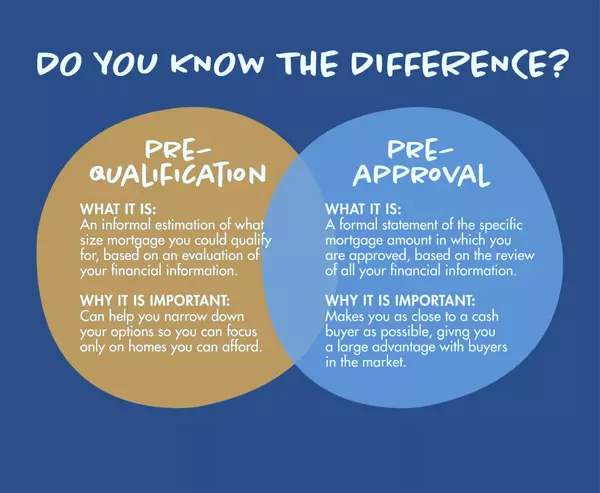

GET YOUR PRE-APPROVAL

Pre-approved buyers are ahead in the home buying game. Some lenders will quickly give you a pre-qualified, but this is not the same thing. A pre-approval letter will give you an edge when multiple offers have been made on the house. You will also close escrow faster since most of the paperwork is already done.

STEP 3: IT'S SHOWTIME BABY

TOUR ONLY BEST HOUSES

WHAT'S REALLY IMPORTANT?

Establish your must-haves. Depending on your outlook, you may think of this part as plotting your strategy or manifesting your ideal home. Whatever you call it, listing out your major wants in a home helps you define your non-negotiable. That way, you won't be distracted by posh staging or the pressure of a fast market. Look at the major wants in combination with neighborhood and commute.

TIME TO MAKE AN OFFER

Now that you found the perfect home it's time for us to draw up the offer. You will want to review this document carefully and make sure it states your terms exactly. In addition to the offer you will need to provide proof of funds and pre-approval letter. After offer is sent, seller will be able to reject, accept or execute a counter offer. In most cases, seller won't accept your offer outright and will send counter.

STEP 4: WELCOME TO ESCROW

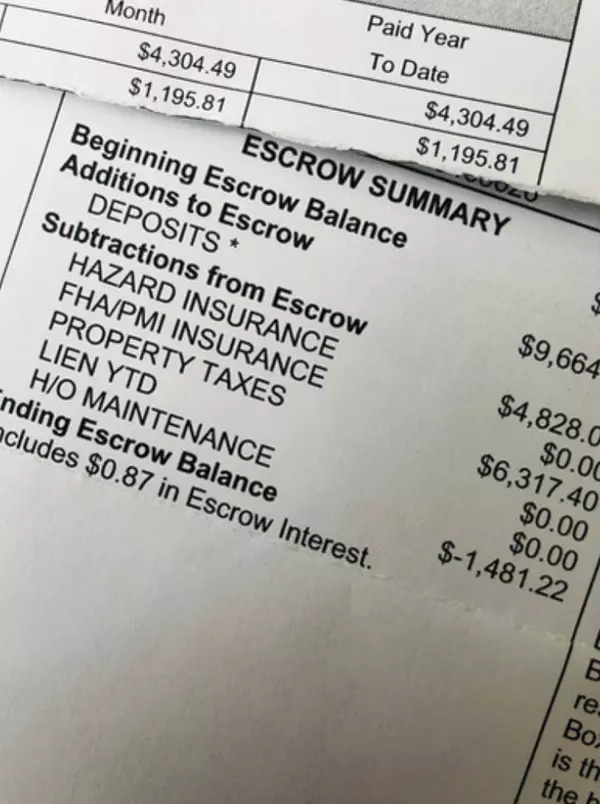

WHAT'S ESCROW?

INSPECTIONS & CONTINGENCIES

You will typically have 17 days for inspections and 21 days for loan contingency. Most buyers will do a home inspection. The goal is for you to get an analysis of the condition of your potential home. You will have an opportunity to request any repairs or back out if major issues are found. Your deposit is always refundable as long as loan contingencies are not removed.

HOME TITLE

Title is the right to own, posses, use, control; and dispose of property. When you buy a home, you are actually buying the seller's title to the home. The purpose of title investigation is to discover any problems. Sometimes "clouds on tile" are found but they can easily be removed prior to closing. When no issues are found, we have a clear title and it can be transferred to the buyer.

APPRAISAL

Once we know title is clear, its time to order appraisal. The appraisal is an estimate of the value of the home made by a qualified professional . The main goal of the appraisal in to justify the lender's investment but it will also help you not to overpay. Lender will order appraisal and buyer will pay for this fee. If appraisal falls short, you may be refused a mortgage or offered a smaller amount.

CLOSING

WELCOME HOME!

This is brilliant news! You survived the home-buying experience and we are here to celebrate with you. Congratulations! A new home is a place for memories to be made and great times to be had. Seriously... read our NEW BUYER GUIDE for some great tips. We care. And you know it. If you know anybody buying or selling, you know we are here to help. Send them to us!

Affordability Calculator

Quite affordable.